franchise tax bd refund

It is important to remember that receiving a refund typically means you are getting back money that you lent to the state interest free for the year. Up to 3 weeks.

Section 19382 authorizes a lawsuit against the board to obtain a postpayment refund of franchise taxes and states.

. Thats really a long delay for a CA tax refund but congrats use it fun-ly. This also happened to me. A State Tax Refund is taxable if you itemized deductions on that prior years federal return and took a deduction for state income taxes instead of the sale tax.

The FTBs Notice of Proposed Assessment Was Invalidly Issued. Up to 3 months. How long it normally takes to receive a refund.

Extra processing time may be necessary. Because the FTB is a tax agency one might assume it is therefore authorized only to collect tax-related debts such as debts incurred through failure to file taxes failure to pay taxes or failure to retain records in. Solution You may be due a refund when filing a California personal income tax return if you overpaid during the tax year.

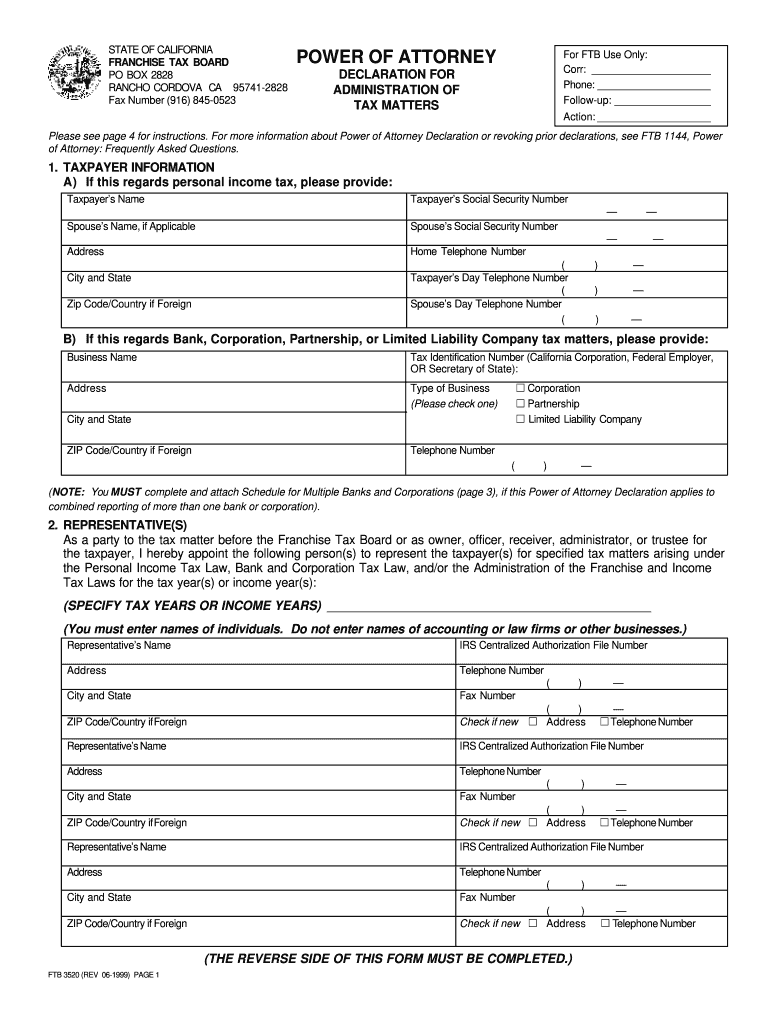

Wait for that letter before you. Section 19385 provides in relevant part. Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives.

Contrary to what the name implies a franchise tax is. Form CT-3-S is used to pay the entity level franchise tax under Article 9-A. Unauthorized access to account information is unlawful as described in Section 502 of the California Penal Code.

The Trial Court Properly Relied on Analogous Federal Authority to Require Resort to the Tax Return in Computing a Deficiency. FRANCHISE TAX BD CASTTAXRFD 022117 XXXXX5 1600 022417 Is this something from my tax return. Franchise Tax Board PO Box 942840 Sacramento CA 942840-0040.

It is important to remember that receiving a refund typically means you are getting back money that you lent to the state interest free for the year. Such tax is the fixed dollar minimum tax imposed under 2101d. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022.

1996 51 CalApp4th 1180 1189 59 CalRptr2d 602 II. You can check the status of your California State tax refund online at the California Franchise Tax Board website. I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year.

Unauthorized access to account information is unlawful as described in Section 502 of the California Penal Code. Franchise Tax Bd. 540 2EZ line 32.

If you received a refund amount different than the amount on your tax return well mail you a letter. You may be due a refund when filing a California personal income tax return if you overpaid during the tax year. Refund amount claimed on your 2021 California tax return.

If the Franchise Tax Board fails to mail notice of action on any refund claim within six months after the claim was filed the taxpayer may prior to mailing of notice of action on the refund claim consider the claim disallowed and bring an action against the Franchise Tax Board on the grounds set forth in the claim for the recovery of. You will need to know the primary Social Security Number complete mailing address and the exact amount of. The corporation must attach Form CT-34-SH to report in aggregate the New York S corporation items that the.

What Is Franchise Tax Bd Tax Refund. I have a traffic ticket which I extended the court date 3 months later. Why did I get the Franchise Tax Board.

Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives. Franchise Tax Bd. 2001 25 Cal4th 508 518 Hoechst Under this scheme the business income of a multistate business is apportioned to each state by formula but nonbusiness income is allocable only to the taxpayers commercial domicile.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. The Franchise Tax Board also helps other governmental agencies in California collect monies owed to them.

Refund amount claimed on your 2021 California tax return. My return in CA is filed electronically every year and I get my refund in about 5 days. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund.

Except as provided in Section 19385 where the board fails to mail notice of action on a refund claim after payment of the tax and denial by the board of a claim for refund any taxpayer claiming that the tax computed and assessed is void in whole or in. Is Franchise tax same as state tax. Contact us about refunds Phone 800 852-5711 916 845-6500 outside the US Weekdays 8 AM to 5 PM Chat Sign into MyFTB to chat Weekdays 8 AM to 5 PM Mail - You may send us a letter asking for a status of your refund.

If you havent filed your income taxes yet visit estimated tax payments. For example the Board is authorized to seize and turn over California tax refunds or California lottery winnings to the appropriate agencies if the lottery winner or the entity that is due a tax refund is delinquent in paying that agency. For 2015 I filed on a Monday and had a refund in my account Friday.

If your business is incorporated in New York State or does business or participates in certain other activities in New York State you may have to file an annual New York State corporation tax return to pay a franchise tax under the New York State Tax Law. A franchise tax is a levy paid by certain enterprises that want to do business in some states. California State Tax Refund Status Information.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version as of the date of certification published by the Web. You got a deduction benefit for it so now you have to include it as income. 540 2EZ line 32.

I received a deposit from franchise tax board not matching what my tax return said do I receive my tax return in amounts. Depending on the size of the refund and the outstanding balance owed the FTB may claim anywhere from a small portion to the entirety of the refund.

Pin By Taron C L On Beyblade Beyblade Burst Imperial Dragon Tomy

Chicago First Alert Weather Back To The Cold Snow Flurries Later Tonight In 2022 Winter Weather Advisory Weather Flurries

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

Bushin Ashura Burst Gt Beyblade B 135 Beysandbricks Dread Saison 4 Bulles Geantes

Bushin Ashura Burst Gt Beyblade B 135 Beysandbricks Dread Saison 4 Bulles Geantes

Esi Return Filing Esi Return Online Enterslice File Income Tax Medical Treatment Filing

Resultado De Imagem Para Beyblade Burst Beyblade Burst Beyblade Toys Beyblade Birthday

Vanguard Cleaning Systems Of Atlanta Company Page Admin Linkedin Atlanta Cleaning Commercial Cleaning Services

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

Assorted Beyblade 38 Variant B 59 Beyblade Toys Beyblade Burst Classic Toys

Liberty Tax Service Liberty Tax Tax Services Event Promo

Forms And Publications Ftb Ca Gov

Top 10 Best Beyblade Toys In The World 2021 Beyblade Toys Beyblade Burst Classic Toys

Infographic Why Choose An Annuity Lifeannuities Com Life Insurance Quotes Life Insurance Marketing Annuity